The Generational Fashion Shift

Few transitions are as culturally significant and commercially potent as the one currently reshaping the Indian wardrobe: the movement from the regal, structured drape of the Saree to the effortlessly cool ease of the T-Shirt. For those who have spent over 25 years immersed in the retail and apparel industry, significant shifts in consumer behaviour have been observed. This change is not merely a matter of changing clothes; it is a profound generational fashion shift driven by rapid urbanisation, extensive digital connectivity, and the relentless pursuit of comfort.

For brands navigating the vast, fragmented Indian market, understanding this pivot is the critical factor distinguishing market leaders from industry footnotes. A dramatic transformation is currently underway, where the demand for traditional garments is increasingly balanced by an explosive growth in comfortable cotton apparel and lifestyle-centric clothing. The Saree, for centuries, represented occasion, status, and heritage. It historically demanded time, patience, and often a formal setting.

Its market dominance was unquestioned, yet its utility in the modern, fast-paced urban environment is naturally limited. The T-shirt has emerged as the ultimate symbol of utility, democracy, and global culture. The T-shirt is now recognised as the uniform of the new India, worn by individuals who commute on the metro, attend gym classes, and manage a dual-income household. This contrast defines the core of the generational fashion shift: Millennials and Gen Z consistently prioritise functionality and individual expression above rigid tradition.

A significant, measurable spike in search traffic for statement t-shirts online is consistently observed, directly reflecting this consumer desire for personalised, accessible fashion. The brands achieving success today are those that recognise that the future lies in delivering high-quality, aspirational, comfortable cotton apparel that speaks to a dynamic lifestyle, rather than solely formal events.

Urban Companies and Their New Creations

Analysis of the competitive landscape, specifically considering brands like Anyaah Clothing—which focuses on high-quality, niche-driven T-shirts for segments like ‘Gym Goers’ and ‘Proud Parents’—reveals that the biggest competitive challenge to legacy ethnic wear players is not just other traditional brands, but the entire ecosystem of casual Indian wear and global streetwear giants. Competitors such as Urban Monkey, Indian Terrain, and even fast-fashion marketplaces that leverage graphic and statement t-shirts online are effectively capturing both the attention and the wallet share of younger consumers who need versatile, daily pieces.

These contemporary brands dominate the search volume for comfortable cotton apparel because they offer immediate relevance to the modern consumer’s daily life, a key differentiator in a market experiencing a widespread generational fashion shift. This massive consumer appetite for effortless dressing proves that the convenience factor is a powerful economic driver in shaping modern Indian fashion trends.

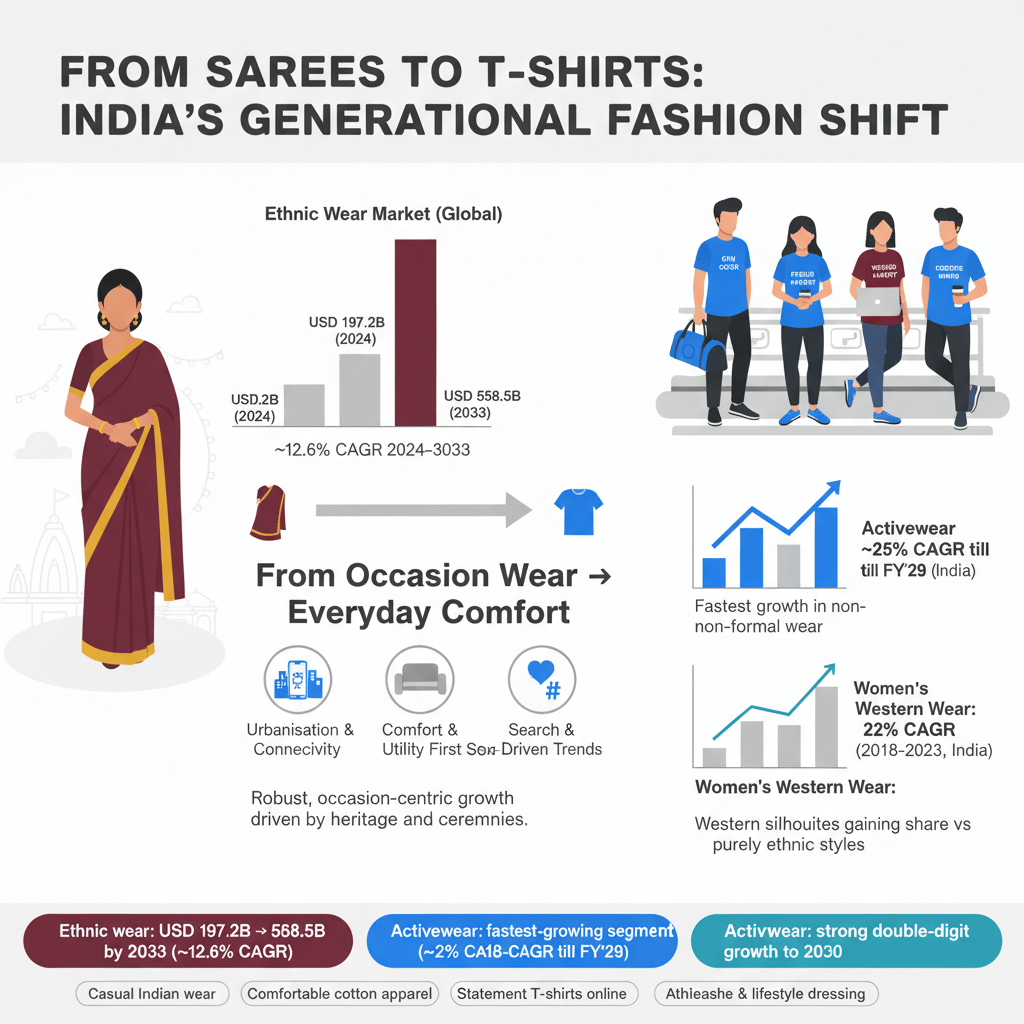

Statistical data emphatically support this observation. While the Indian ethnic wear market remains robust, valued at approximately USD 197.2 billion in 2024 and projected to reach USD 558.5 billion by 2033, indicating a healthy 12.6% CAGR, the growth narrative is complex. The real story centres on the acceleration within non-traditional segments. The demand for casual Indian wear is soaring. The growth of activewear, a direct competitor to formal dressing, is forecast at a striking 25% CAGR until FY’29, significantly outpacing the general apparel market’s estimated 4.02% CAGR.

This substantial difference highlights how quickly the generational fashion shift is redirecting consumer spending towards comfort and utility. Consequently, retailers must adapt their strategies from seasonal wedding collections to year-round drops of high-demand items, such as comfortable cotton apparel. This evolution has been largely fueled by the digital revolution. E-commerce platforms have certainly made it easier to buy ethnic wear online, but more importantly, they have democratized access to global modern Indian fashion trends.

Younger demographics are constantly exposed to international styling cues via social media, which directly drives demand for items like oversized fits and statement t-shirts online. The rise of the ‘athleisure’ category—perfectly represented by high-quality T-shirts and relaxed silhouettes—is a prime example of this digital influence translating into concrete sales, with this segment seeing a 12% rise in sales between 2022 and 2024. The versatility of casual Indian wear meets the global desire for comfort, creating a powerful market synergy that defines the ongoing generational fashion shift.

Further Importance of Casual Cotton Apparel

The modern professional woman, for instance, requires attire that seamlessly transitions from a hybrid office setting to an evening outing. This consumer greatly values a wardrobe built on high-quality, comfortable cotton apparel that requires minimal maintenance. This shift has not eradicated the ethnic market, but it has certainly necessitated its radical transformation. Significant growth is observed in fusion wear—examples include embroidered cotton tees paired with palazzos, or stylised kurtis that function effectively as longline shirts. This hybridisation represents the commercial nexus point of the modern Indian fashion trends.

To truly succeed in this environment, brands must invest heavily in data analytics to track precisely what consumers are searching for after the initial interest. Are they seeking “printed tee for gym” or “premium saree”? The data will almost always skew toward practical, everyday casual Indian wear. This analytical insight must dictate inventory allocation, marketing spend, and product development, emphasising core segments like comfortable cotton apparel. The effective strategy is simple: dominate the high-volume searches for statement t-shirts online and lifestyle apparel, and then utilise that traffic to cross-promote select ethnic items.

Consider the enormous economic shift documented in market reports, which projected the women’s western wear segment in India to have grown at a massive 22% CAGR between 2018 and 2023. This acceleration illustrates the overwhelming consumer preference for styles rooted in Western silhouettes, like the T-shirt, over traditional, high-maintenance drapes like the Saree. This projection is a clear indicator that the generational fashion shift is moving at an aggressive pace. Brands that do not incorporate comfort-driven, versatile casual Indian wear into their core offering are missing the largest segment of opportunity.

The challenge for marketing executives involves creating emotional resonance within a utility-driven segment. How can a high-quality, comfortable cotton apparel T-shirt be made to feel as aspirational as a hand-woven silk Saree? The solution lies in powerful storytelling and hyper-targeted niche marketing. Anyaah Clothing’s strategy of speaking directly to the ‘Biker’ or the ‘Proud Parent’ is a prime example; they succeed by turning a commodity (the T-shirt) into a statement of identity. They effectively sell lifestyle, not just fabric. This approach is paramount for driving high-intent conversions and capitalising on searches for statement t-shirts online.

Furthermore, a successful digital strategy in this space requires deep content marketing that positions the brand as a thought leader in modern Indian fashion trends. This blog, for example, serves as an expert opinion piece, but internally, brands must nurture their own content ecosystems. It is crucial to use internal links strategically; speaking of the balance between heritage and modernity, the importance of sustaining traditional weaving techniques was explored in depth in a recent piece—a fascinating read that provides context to the very fabrics that underpin the evolution from Saree to T-Shirt.

The effects of this massive generational fashion shift continue to play out on social platforms, where visibility depends entirely on aligning with lifestyle content, whether focused on fitness, travel, or parenthood. In conclusion, the journey from Sarees to T-shirts should be viewed not as a tale of replacement, but one of inclusion. The Saree will always hold its irreplaceable niche, especially within festive and ceremonial segments. However, the commercial volume, the scale of daily demand, and the dominant search interest now squarely belong to casual Indian wear, comfort-centric clothing, and highly specific, niche-focused statement t-shirts online.

For marketers, the mandate is clear: embrace the modern Indian fashion trends driven by comfort, utilise high-volume keywords like comfortable cotton apparel, and leverage data to master the generational fashion shift. The future of the Indian apparel market is highly competitive, highly digital, and unequivocally comfortable. Success will be determined by how quickly brands can pivot their narrative from occasion wear to everyday relevance, providing the premium, comfortable cotton apparel that the new generation demands.

Mastering the digital storefront and optimising content for searches such as “buy statement t-shirts online” remains the most powerful lever for driving sustained growth in this exciting era of modern Indian fashion trends.